What Is The Capital Gain Tax Rate For 2025 - How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, 10.85% (e) washington (d, k) 0%. Married filing jointly, eligible surviving spouses: 2025 Long Term Capital Gains Rates Alfie Kristy, Profits or losses derived from the buying and selling of. Tsx ends up 1% at 22,165.15 posts eighth straight weekly gain investors raise bets on boc rate hike in june materials group rises 2%, energy up 1.3% april 5.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, 10.85% (e) washington (d, k) 0%. Married filing jointly, eligible surviving spouses:

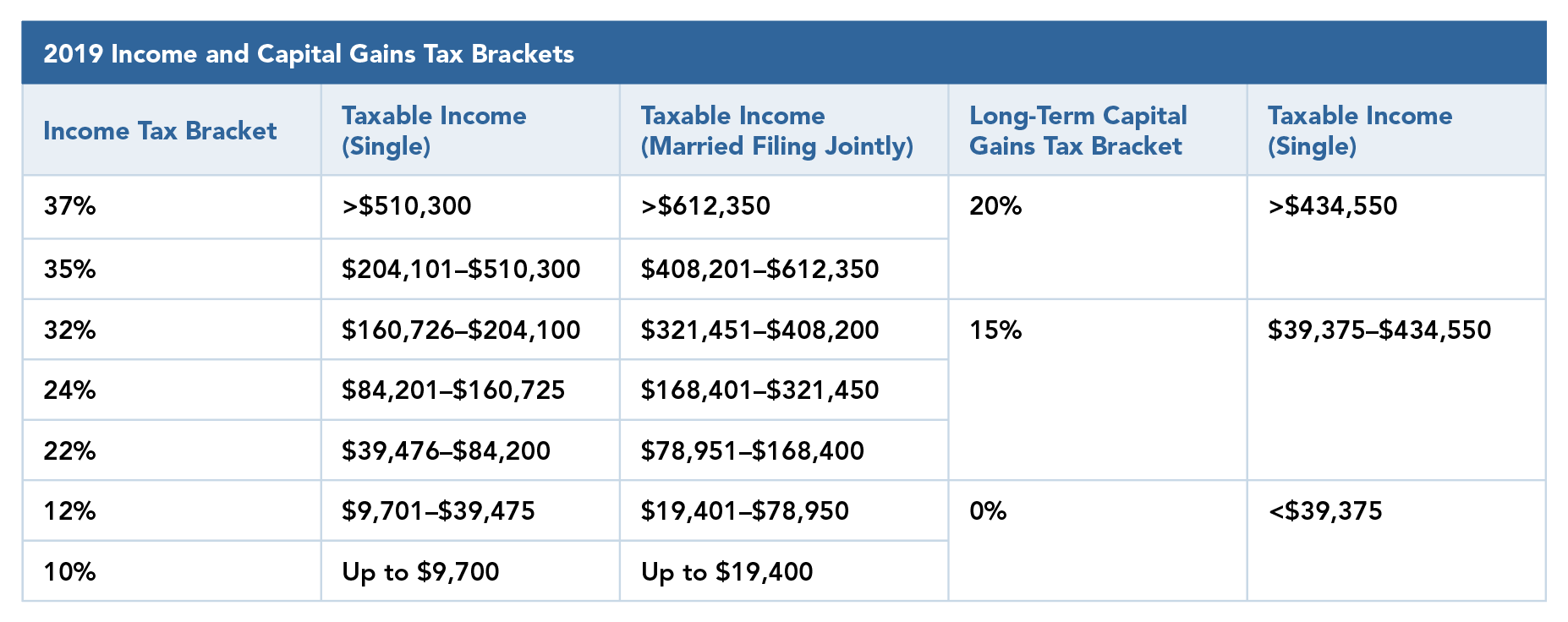

They are taxed at favorable. For the 2025 tax year, individual filers won’t pay any capital gains tax if their total taxable income is $47,025 or less.

Chris Brooks Obituary 2025. The albert memorial, on the edge of london's kensington gardens, is […]

Irs 2025 Tax Brackets Vs 2025 Natty Viviana, Martin ramin/the wall street journal, styling by sharon ryan/halley resources. What is the current tax rate on capital gains and dividends?

Rose Parade Channel 2025. In los angeles the parade will also air. L.a.’s very own […]

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, There are two main categories for capital gains: For the 2025 tax year, the highest possible rate is 20%.

Tsx ends up 1% at 22,165.15 posts eighth straight weekly gain investors raise bets on boc rate hike in june materials group rises 2%, energy up 1.3% april 5.

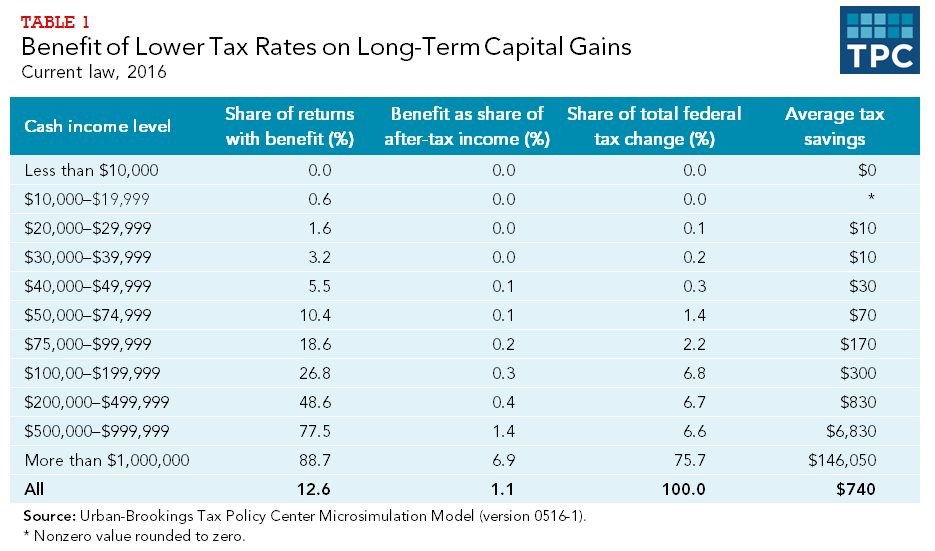

Capital gains tax rates How to calculate them and tips on how to, What is the current tax rate on capital gains and dividends? Profits or losses derived from the buying and selling of.

What Is The Capital Gain Tax Rate For 2025. 2025 capital gains tax brackets. For the 2025 tax year, the highest possible rate is 20%.

Capital Gains Tax Rate Bridie Bloom, Annual exempt amount limits and rates for capital gains tax have been updated for the 2025 to 2025 tax year. For the 2025 tax year, the highest possible rate is 20%.

Capital Gains Tax They apply to most common investments, such as, Annual exempt amount limits and rates for capital gains tax have been updated for the 2025 to 2025 tax year. Martin ramin/the wall street journal, styling by sharon ryan/halley resources.